A University of Cambridge academic is warning the global recession is likely to be long lasting, with no country escaping the impact of Covid-19 regardless of their mitigation strategy.

“The Covid-19 pandemic is a global shock ‘like no other’, involving simultaneous disruptions to both supply and demand in an interconnected world economy,” says Kamiar Mohaddes, a Fellow in Economics at King's College, Cambridge.

“We’ll still be feeling the economic consequences of Covid-19 for many years if not the rest of the decade” he says, calling for a coordinated multi-country policy response to the pandemic.

“On the supply side, infections reduce labour supply and productivity, while lockdowns, business closures, and social distancing also cause supply disruptions. On the demand side, redundancy and the loss of income from death, quarantines, and unemployment plus worsened economic prospects reduce household consumption and firms’ investment.”

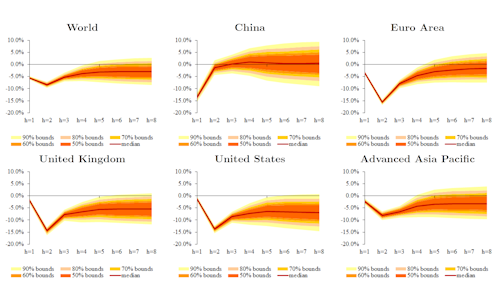

He says analysis of the impact of covid on economic activity indicates the pandemic will likely knock three percentage points off real world GDP by the end of 2021. “Our results suggest that the US and the UK are quite likely to experience deeper and longer-lasting effects, while China’s outcome has more than a 50% chance of being much better,” he says. “The odds for the euro area are skewed negatively, but it’s likely it will recover faster and more solidly than the US by the end of 2021.”

Pulled by China, the rest of “Emerging Asia” has a higher chance of performing better than the global average. However, non-Asian emerging markets stand out for their vulnerability. “They will likely suffer from a significant output collapse in 2020. Turkey, South Africa, and Saudi Arabia will almost certainly see at least eight quarters of severely depressed economic activity,” he adds.

However, he warns that that the economic losses associated with the pandemic could be even larger as “with every easing of social distancing restrictions, the infection rates could rise again, which would require re-imposition of those restrictions, as we have seen in Europe and parts of the United States lately, dampening economic activity and confidence further.”

In his recent study together with Alexander Chudik (Dallas Fed), M. Hashem Pesaran (USC and Trinity College, Cambridge), Mehdi Raissi (International Monetary Fund), and Alessandro Rebucci (JHU) they also look specifically into Sweden’s experience as it didn’t enter a full lockdown, but which suffered from spillover effects. “As is well know, Sweden has a distinctly different policy approach toward the pandemic,” he says. “Our estimates for Sweden illustrates that no country is immune to the economic fallout of the pandemic because of interconnections and the global nature of the shock. The Swedish economy will see a real downturn in GDP too, very similar to other European economies.”

With a second national lockdown in England and stricter restrictions being imposed across the world, he is calling for global action and policy interventions to protect lives and livelihoods by continuing to support firms and households as well as maintaining the normal functioning of financial markets.

The study by Alexander Chudik, Kamiar Mohaddes, M. Hashem Pesaran, Mehdi Raissi, and Alessandro Rebucci entitled "A Counterfactual Economic Analysis of COVID-19 Using a Threshold Augmented Multi-Country Model", is available at:

https://www.inet.econ.cam.ac.uk/research-papers/wp-abstracts?wp=2040

Tags: